The Perfect Economic Storm: $LAM combines the deflationary power of burning, the growth velocity of network effects, and the value creation of real B2B revenue. This isn’t speculation—it’s an economic revolution backed by actual utility.

The $LAM Economic Model

A New Paradigm for AI Ownership

The $LAM token represents more than cryptocurrency—it’s the foundation of a new economic system where AI value flows to the community that creates it, not corporate shareholders. Every aspect is designed to create sustainable, long-term value appreciation.Deflationary by Design

34% of every token used is burned forever, creating permanent scarcity

Revenue-Backed

B2B subscriptions create continuous buy pressure through the buyback mechanism

Community-Driven

35% of supply distributed to trainers, creators, and network builders

The Deflationary Engine

How Scarcity Drives Value

Burn Mechanics

Action Execution

User or business executes an AI action that consumes tokens based on current pricing

Revenue Cycle

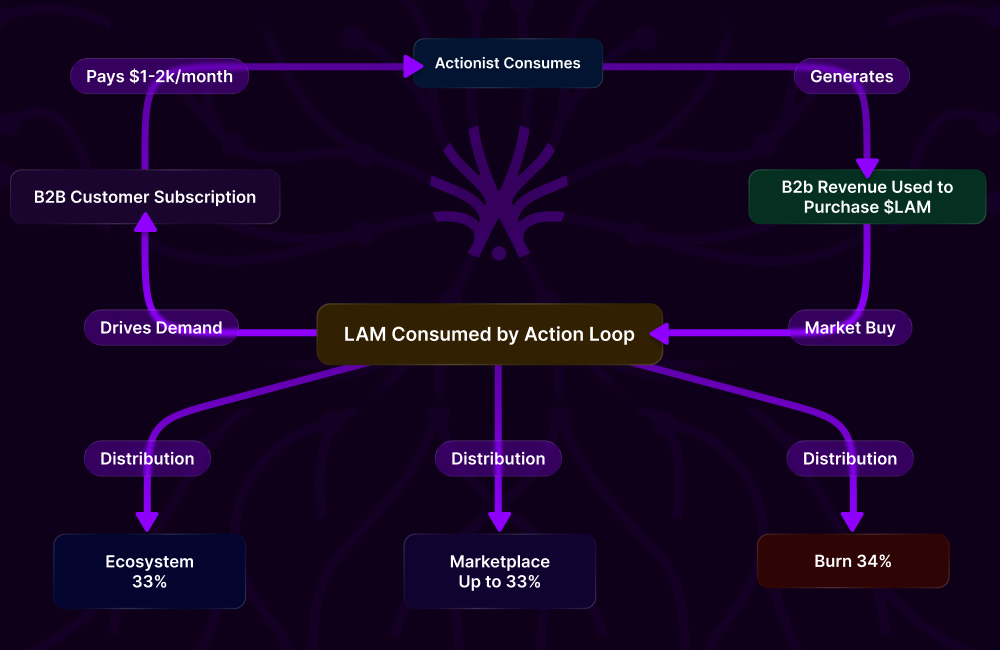

The B2B Buyback Loop

How Revenue Creates Value

Step 1: Enterprise Subscriptions

Step 1: Enterprise Subscriptions

B2B SaaS Model:

- Enterprises pay $1,000-2,000/month per AI agent

- Payment in fiat for predictable budgeting

- Unlimited actions within tier

- 24/7 cloud VM operation

- Target: 100,000 enterprises by 2027

- Average: 5 agents per enterprise

- Potential: $500M-1B annual revenue

Step 2: Token Buyback

Step 2: Token Buyback

Automatic Market Operations:

- 80% of revenue allocated to buyback

- Daily market purchases

- Multiple DEX/CEX execution

- Price-supportive buying

- Continuous buy pressure

- Price floor support

- Reduced circulating supply

- Positive price momentum

Step 3: Agent Operations

Step 3: Agent Operations

Token Consumption:

- Agents perform thousands of daily actions

- Each action consumes tokens at market rate

- Consumption scales with usage

- Creates natural demand

- Average agent: 5,000 actions/day

- 500,000 agents = 2.5B daily actions

- Massive token velocity

Step 4: Distribution & Burn

Step 4: Distribution & Burn

Value Flow:

- 34% burned (deflationary pressure)

- Up to 33% to creators (incentive alignment based on Creator Epoch)

- 33% to foundation (sustainability)

- Burning reduces supply

- Creator rewards drive quality

- Foundation funding ensures growth

Economic Incentives

Aligning All Stakeholders

- Users/Trainers

- Creators

- Enterprises

- Investors

Why Users Participate

Immediate Benefits:- Earn tokens for browsing normally

- Passive income from referrals

- Early access to AI automation

- Ownership in the platform

- Token appreciation potential

- Governance rights

- Revenue sharing eligibility

- Network effects compound

Velocity and Circulation

Token Flow Dynamics

High Velocity, Low Float: Tokens constantly circulate through the economy—earned, spent, burned, and re-earned. This creates healthy velocity while burning reduces float.

Circulation Patterns

Earning Flows

Tokens Enter Circulation:

- Training rewards distributed

- Referral commissions paid

- Creator earnings credited

- Staking rewards released

Burning Flows

Tokens Exit Circulation:

- Action execution burns

- Voluntary burning events

- Failed transaction burns

- Penalty burns

Trading Flows

Secondary Market:

- DEX swaps

- CEX trading

- P2P transfers

- Liquidity provision

Utility Flows

Platform Usage:

- API consumption

- Subscription payments

- Marketplace purchases

- Premium features

Price Discovery Mechanism

How Value Is Determined

Market-Driven Pricing: Unlike stablecoins or pegged assets, $LAM price floats freely based on supply, demand, and utility value. This allows for appreciation as the platform grows.

Price Factors

| Factor | Impact | Direction | Magnitude |

|---|---|---|---|

| Token Burns | Reduces supply | ⬆️ Positive | High |

| B2B Revenue | Creates buy pressure | ⬆️ Positive | High |

| User Growth | Increases demand | ⬆️ Positive | Medium |

| Creator Activity | Enhances utility | ⬆️ Positive | Medium |

| Market Sentiment | Affects trading | ↕️ Variable | Variable |

| Competition | Market share impact | ⬇️ Negative | Low |

Sustainability Model

Long-Term Economic Viability

Revenue Diversification

Multiple revenue streams ensure sustainability:

- B2B subscriptions (primary)

- API usage fees

- Marketplace commissions

- Premium features

- Enterprise services

Cost Optimization

Efficient operations maintain profitability:

- Automated systems

- Community-driven development

- Decentralized infrastructure

- Minimal overhead

Treasury Management

Strategic reserves ensure longevity:

- Operating reserves

- Development fund

- Emergency fund

- Growth capital

Market Opportunities

Capturing Value Across Multiple Revenue Streams

Action Model is positioned to capture value across multiple trillion-dollar markets through diversified revenue streams:- Data Licensing: Proprietary LAM training data from millions of users

- B2B SaaS: Enterprise automation agents at $1-2K/month

- API Platform: Developer ecosystem generating billions of API calls

- Marketplace: Commission on workflow and agent sales

- Infrastructure: DePIN network, distributed computing, proxy services

- Professional Services: Implementation, consulting, and training

- Automated Testing: QA automation for dev teams pushing software updates

- Industry Verticals: Call centers, financial services, healthcare, e-commerce

Explore Full Market Analysis

Discover the trillion-dollar opportunity landscape and how Action Model captures value at every layer

Join the Economic Revolution

Start Earning

Begin training and earning your stake in the AI economy

Become a Creator

Build workflows and earn from every usage

This isn’t just tokenomics. It’s the blueprint for economic revolution. Where AI value flows to those who create it. Where usage drives scarcity. Where community owns the future. The economy is being rewritten. Will you own a piece?